do you have to pay inheritance tax in kansas

Inheritance tax is a creature of state law. There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person.

Kansas Estate Tax Everything You Need To Know Smartasset

You would owe Kentucky a tax on your inheritance because Kentucky is one of the six states that collect a state inheritance tax.

. Kansas has no inheritance tax either. Kansas has no inheritance tax either. The estate tax is not to be confused with the inheritance tax which is a different tax.

Your relationship with the deceased. But six states do have levies that apply to heirs. Only six states impose an inheritance tax.

The state in which you reside. There is no federal inheritance tax but there is. Up to 15 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. If you dont pay or make arrangements to settle your. Income Tax Range.

Below well go through several key rules to help you determine when you might have to pay taxes on an inheritance. 31 on 2501 to 15000of taxable income for single filers and 5001 to 30000for joint filers. The amount of inheritance tax that you will have to pay depends on.

Pennsylvania Nebraska Iowa Kentucky New Jersey. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. If you receive an inheritance from an out-of.

57 on more than 30000 of taxable. Iowa Kentucky Maryland Nebraska New Jersey and. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

The estate tax is not to be confused with the. The IRS does not assess inheritance tax. The flip side is if you live in Kentucky and your.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Most states dont charge inheritance taxes either. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

State inheritance taxes. Whether or not you have to pay inheritance tax depends on. The inheritance tax applies to money or assets after they are already passed on to a.

You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you. The size of the inheritance.

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

Kansas State Taxes 2021 Income And Sales Tax Rates Bankrate

English In 1904 The Mayor Of Severance Kansas Announced That A Bachelor Tax Would Be Imposed On All Residents Of His Town Who Were Not Married By The End Of The Year

Death And Taxes Nebraska S Inheritance Tax

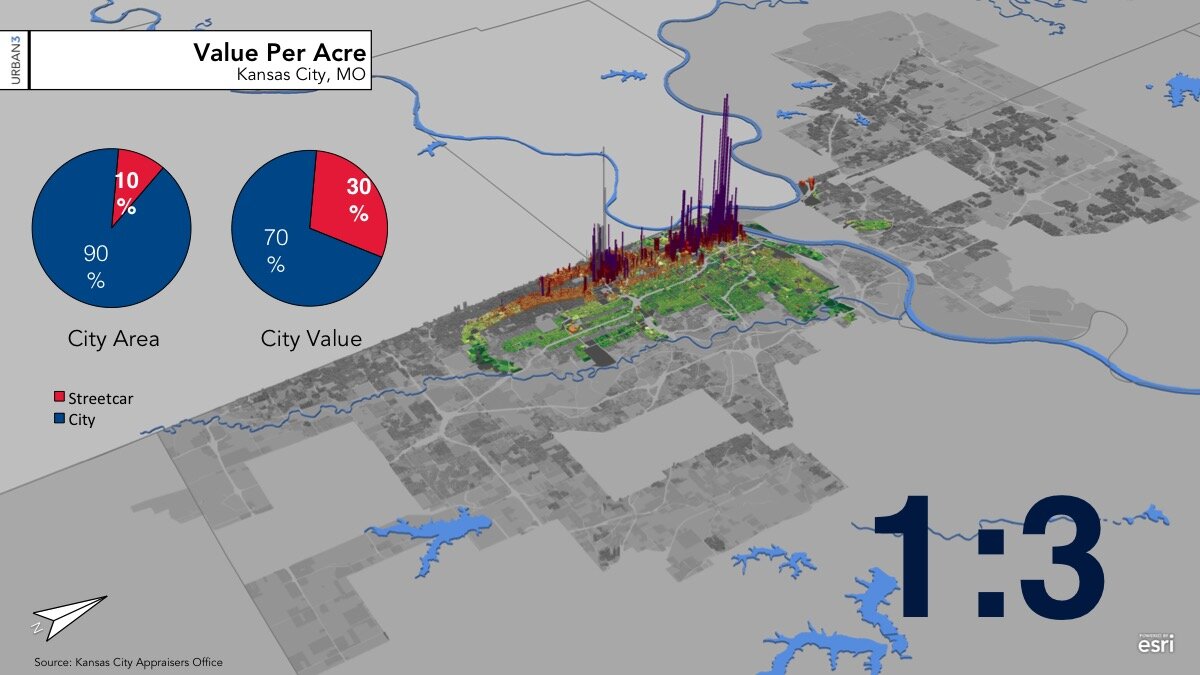

Is Kansas City Still Living On Its Streetcar Era Inheritance

Avoiding Estate Taxes Estate Planning Attorneys In Missouri And Kansas

Kansas Transfer On Death Deed Kansas Legal Services

Does Kansas Charge An Inheritance Tax

The 10 Least Tax Friendly States For Middle Class Families Kiplinger

Kansas Retirement Tax Friendliness Smartasset

Fillable Online Kansas Inheritance Tax Return Fax Email Print Pdffiller

Events At Jccc S Kansas Sbdc And Our Partner Organizations Kansas Small Business Development Center At Jccc

State By State Estate And Inheritance Tax Rates Everplans

Will And Trust Seminar Event Archdiocese Of Kansas City In Kansas

September 2006 Journal Of The Kansas Bar Association By Kansas Bar Association Issuu

Kansas Inheritance Laws What You Should Know

Frequently Asked Questions About Probate Kansas Legal Services